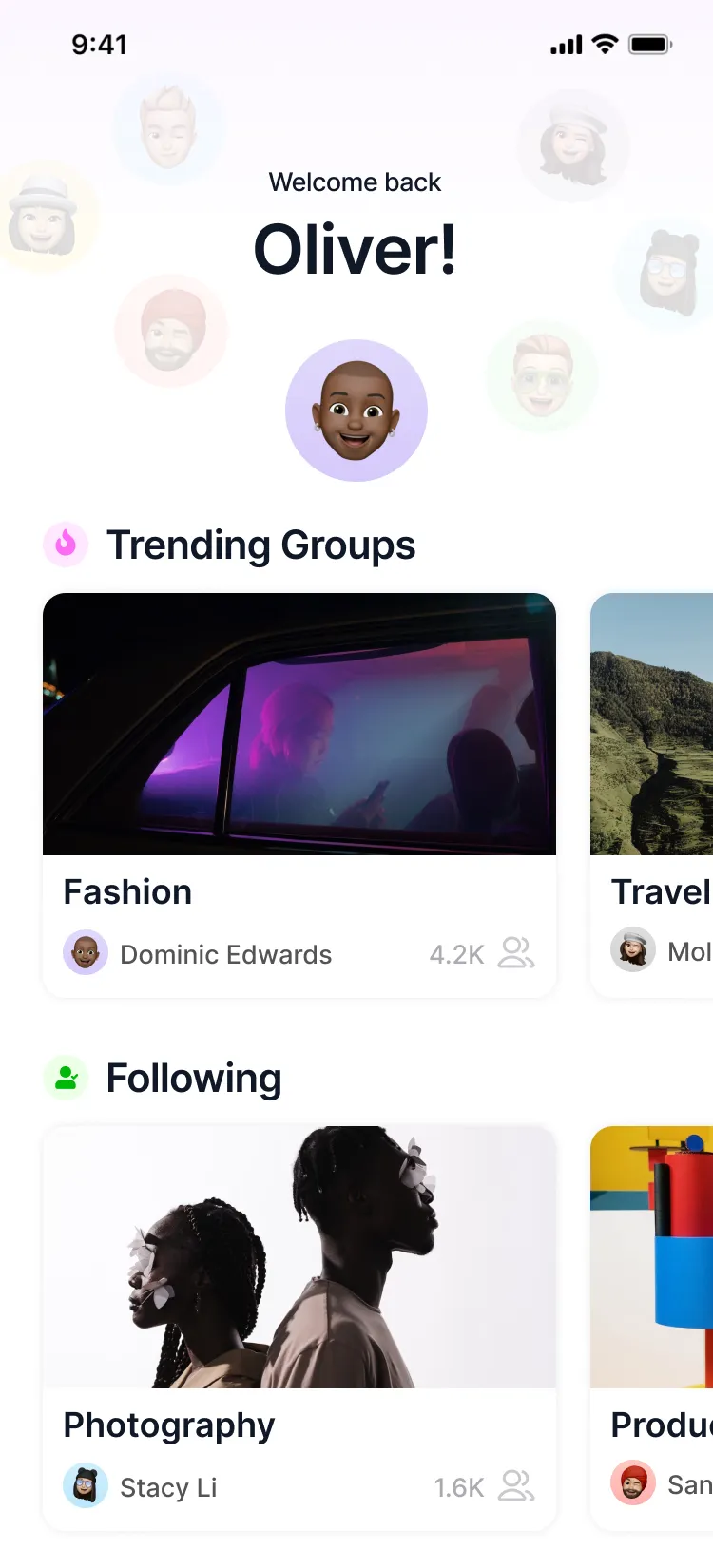

Catamaran

Version 2.0

Our latest updates

🔥 Advanced Wildfire and Weather Data

Catamaran has significantly expanded its wildfire data capabilities, evolving from real-time wildfire monitoring to a comprehensive historical wildfire dataset covering incidents all the way back to 1900. This enhancement gives insurers and risk managers unparalleled insight into wildfire patterns, frequency, and severity over an extensive historical timeline.

Additionally, we now provide detailed fire hazard zoning information for key regions, including California and other wildfire-prone states, helping users quickly identify high-risk areas and integrate precise hazard assessments into their underwriting process.

We’ve also introduced valuable data on controlled burns, allowing insurers to evaluate the effectiveness of mitigation efforts and better estimate the likelihood and impact of future wildfire events. With these advancements, Catamaran now offers one of the most complete and insightful wildfire intelligence tools on the market.

🤖 Agentic AI: Next-Generation Property Risk Assessment

Catamaran AI introduces a groundbreaking multi-model AI consensus system for property risk assessment, harnessing the combined analytical strength of five leading AI models—Perplexity, Anthropic, OpenAI, Mistral and Deepseek. Each AI model independently evaluates critical property risk factors, such as structural vulnerabilities, climate exposure, historical loss patterns, aerial property assessments, real-time flood mapping, and hurricane track modeling. This multi-perspective approach cross-validates findings in real-time, generating robust confidence-weighted risk scores. The system ensures unprecedented transparency, clearly documenting the rationale behind each risk factor assessment, including source citations and explicit confidence levels. This innovative method significantly improves accuracy and reliability, enabling insurers to offer fairer premiums, especially for complex coastal property risks, and empowers policyholders with greater clarity and trust.

🛠️ Developers: Powerful APIs for Catastrophe Analytics

Catamaran now offers a robust and developer-friendly API, enabling seamless integration of advanced catastrophe analytics directly into your own applications. Easily embed sophisticated risk modeling, historical event data, parametric payout simulations, and real-time risk tracking into your existing workflows or products.

Built with flexibility and scalability in mind, Catamaran’s API empowers developers, insurers, brokers, and third-party platforms to enhance their offerings quickly, reliably, and securely—leveraging the full analytical power of Catamaran from within their own environments.

🌎 Enhanced Earthquake & Weather Analysis

We’ve introduced Peak Velocity Analysis (PVA) as a robust new methodology for earthquake-triggered parametric payouts. This method uses ground-motion intensity measurements, resulting in more accurate and transparent coverage that closely aligns payouts with actual event severity.

In addition, we have upgraded our windspeed parametric modeling. Our refined payout tables now account for more granular variations in wind exposure, offering highly targeted and efficient coverage for policyholders facing wind-related risks such as hurricanes and severe storms.

We’ve also enhanced our drought-risk analytics. Our improved parametric logic simplifies the process of managing drought coverages, especially across portfolios with multiple locations.

🌎 Dedicated Parametric Portal

Catamaran’s specialized parametric portal provides a focused environment to explore, structure, and manage parametric risk transfer strategies across key perils: Severe Convective Storms (SCS), Wildfire, and Wind.

The portal offers insurers, brokers, and corporate risk managers direct access to advanced analytics and intuitive visualization tools, enabling deeper insights into risk exposure and potential losses. Users can efficiently simulate various scenarios, compare trigger options, and visualize how different parametric coverages would perform under real-world events.

With intuitive navigation and comprehensive support for structuring parametric products, CatamaranParametric.com simplifies complex risk assessment, helping you make informed decisions swiftly and confidently. It’s your go-to destination for parametric risk management, where clarity meets innovation in risk transfer.

📄 Next Generation Document Processing

Catamaran’s breakthrough in document processing technology has transformed natural catastrophe insurance automation, increasing readability from 89% to an impressive 97% of all insurance documents. This critical advancement closes the automation gap that has long challenged the industry.

By integrating enhanced OCR capabilities, we’ve completed our end-to-end natural catastrophe insurance workflow. The system now seamlessly handles document analysis, underwriting decisions, pricing calculations, and sophisticated risk modeling—all within a single, cohesive platform.

This technological leap means that previously problematic document formats and complex insurance terminology no longer require manual intervention. The result is dramatically faster processing times, reduced operational costs, and significantly improved accuracy across your catastrophe insurance operations.

Our complete natural catastrophe underwriting solution enables insurers, brokers, and risk managers to respond with unprecedented speed and precision to market opportunities.

Coming soon

Enhanced workflows for easy integration with third-party modeling APIs, providing rapid and direct access to key modeling results directly within Catamaran.

Integration of next-generation predictive weather models including GenCast and Pangu-Weather.

A complete solution to manage policy underwriting guidelines, run the full quote-and-bind process, monitor aggregations, and secure capacity effortlessly through CatX—your true one-stop shop for MGAs and Captives.

We’re transitioning powerful weather and catastrophe models to the cloud, significantly reducing computational burdens and ensuring faster, more scalable risk assessments for your team.

View a demo. See Catamaran in action.

Book a meeting

Contact our team to see what Catamaran can do for you.