Total risk intelligence

for

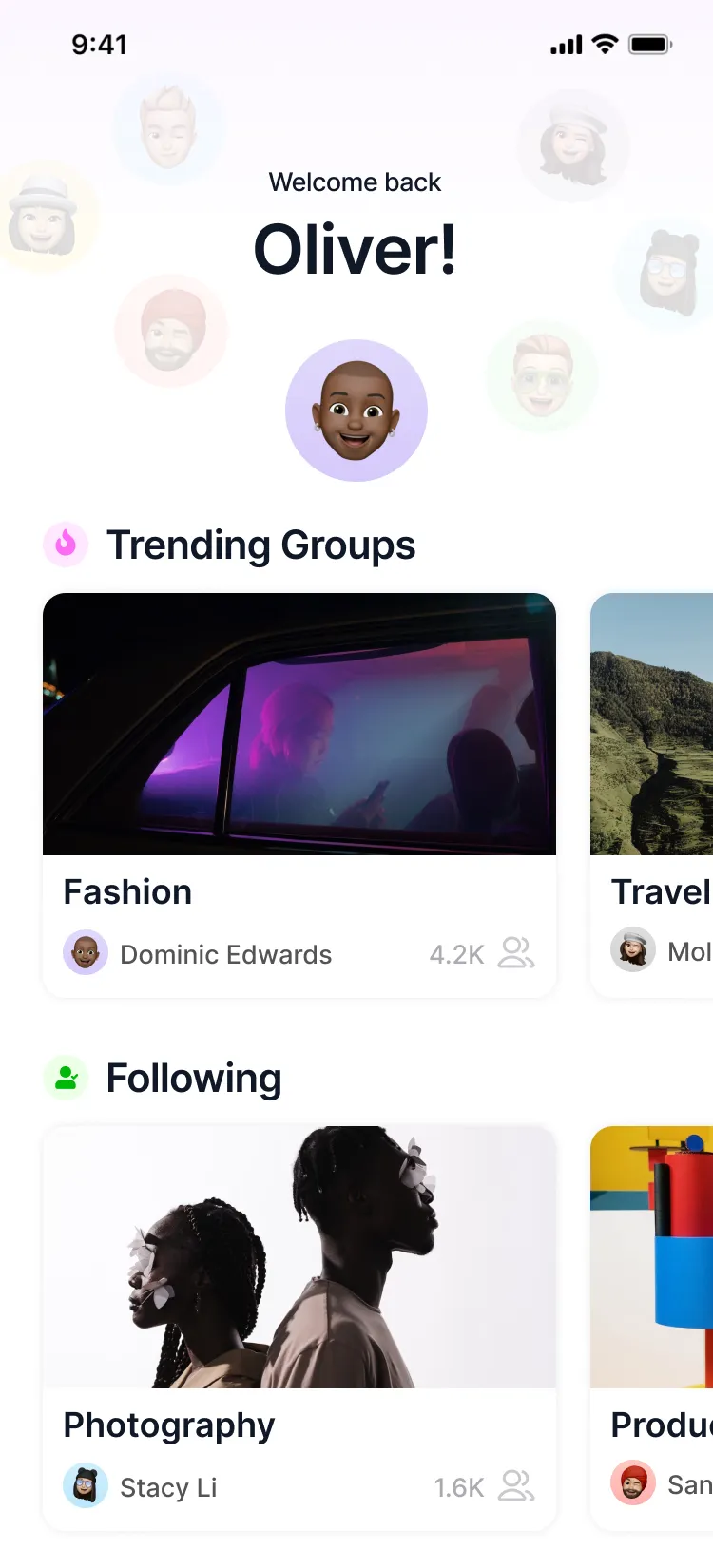

Catamaran is the risk decision platform, helping corporates, brokers, insurers and investors to analyze and transfer complex risks. It is built on rich datasets, powerful models and advanced artificial intelligence.

Extract

Catamaran’s extraction tools pull from relevant sources— such as insurance submissions or exposure documents. We consolidate, clean, and normalize every data point so that you can focus on what matters: making informed decisions. Our end‐to‐end approach ensures no vital piece of information slips through the cracks, giving you the clarity needed to move forward with confidence.

Accurate data extraction designed for insurance

Structure in any common insurance format such as MRC V-3

Integrate into workflows, policy admin systems or as a broker portal

Automated triaging and matching

Parametric Protection for Florida

6 locations in Florida

74% completed

6

2

Add a new task

Analyze

Quickly assess the frequency, magnitude, and underlying trends of your risks. Whether you’re evaluating potential payouts or projecting scenarios for future events, our system handles complex data sets with ease. We deliver this intelligence in intuitive dashboards and concise reports, enabling you to iterate faster on coverage parameters.

Configure parametric triggers, coverage thresholds, and payouts

Use our powerful multi-modal AI analysis to understand risk

Analyze scenarios to understand average annual and maximum

probable loss.

Structure

Catamaran’s structuring process helps you configure triggers, coverage thresholds, and payout mechanisms to reflect your exact needs. Every parameter is informed by real‐time data modeling, ensuring fairness and responsiveness. Our commitment to transparency means you’ll see precisely how each decision affects potential outcomes, guaranteeing a coverage structure you can stand behind. Because when your policy is built on precise metrics, you can trust it to hold strong under pressure.

Configure parametric triggers, coverage thresholds, and payouts

Build submissions with multiple structure options

Transact

Catamaran and CatX streamlines the entire risk transfer process—from digital underwriting to policy execution—by connecting you directly with institutional and alternative capital partners. Whether you’re finalizing placement or scaling your program, we speed up deal flow and accelerate time to coverage. When a triggering event occurs, automated settlement kicks in, ensuring fast payouts and minimal friction. With a global network of specialized capital providers at your fingertips, you can continuously optimize risk transfer to match your evolving exposures.

Access new sources of capital from institutional investors

Investors can access high-return, uncorrelated investment

opportunities

We offer a full-suite of tools to go from quoting and data extraction through to risk transfer.

Transform unstructured documents in any format into powerful digital deal rooms

Compare and test a variety of structures to find the most appropriate risk transfer approach

Calfornia Earthquake

6 polygons in California

Access new sources of risk capital from leading institutional investors through the CatX marketplace

Reduce manual effort through automated document processing and had handling

Designed for insurance

All formats

Data cleansing & validation

Powerful model ensemble

Catamaran and CatX platforms Powerful tools to extract data, analyze risks and transact with counterparties.

Risk Scoring

Quantify your exposures to understand vulnerabilities at a glance.

Triaging

Quickly identify and prioritize opportunities aligned with your appetite.

View a demo. See Catamaran in action.

Book a meeting

Contact our team to see what Catamaran can do for you.